Daniel Susskind’s A World Without Work: Technology, Automation and How We Should Respond is a very nice overview of the issues related to technological unemployment – will it happen, how will it affect people, and what policy responses might make sense. As the book notes, it is impossible to predict the number/proportion of jobs that might be affected, or how quickly, with detailed studies coming up with numbers ranging from about a tenth to about a half. But that there will be disruption, and that past policies have not dealt well with the consequences, is far less uncertain. Even if you believe that the economy will in time adjust the types and amount of work available – and so in that sense this time is *not* different from the past – the transition could be painful.

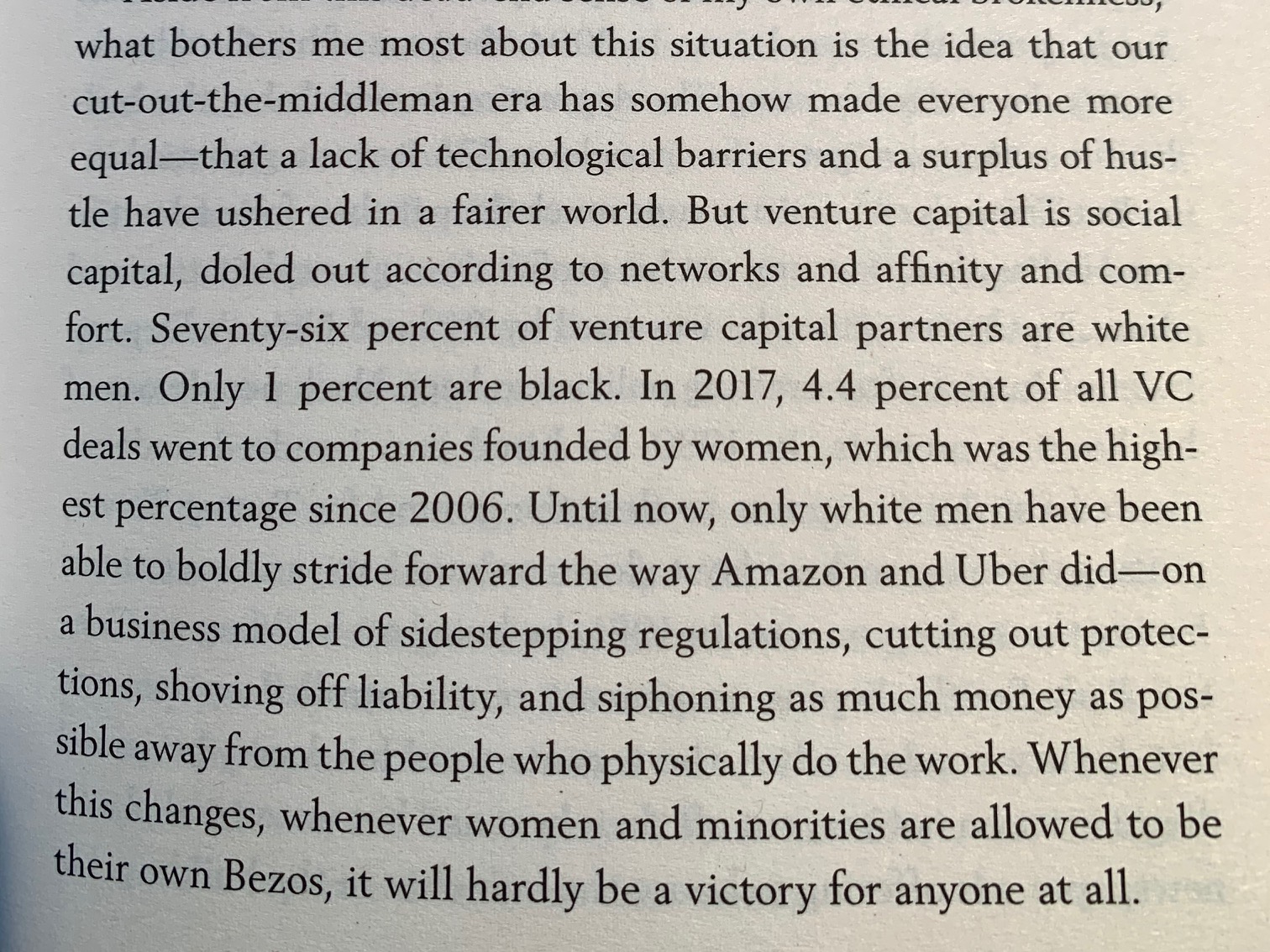

The book has three sections. The first looks at the history of technological unemployment and why we might expect AI to lead to a new wave. The second sets out the task-based analysis introduced by David Autor and others to sketch how the character of people’s work can change significantly. While dismissing the lump of labour fallacy, it argues that one of the main symptoms will be increased inequality. It predicts, gloomily, that this will get worse and that some people will be left with no capital and redundant human capital,, “leaving them with nothing at all.” I’m not sure that will be politically viable, judging from current events, but the logic is straightforward.

The final section turns to potential policy responses: improved education – heaven knows, we need that; ‘Big State’ – “a new institution to take the labour market’s place” – in effect more tax and a UBI; and tackling Big Tech through competition policy – yep, I’m definitely up for that. Finally, Susskind argues that part of the role for the Big State is to ensure we all have meaning in our working lives, replacing the job as the source of people’s identity, though I wasn’t sure how this should happen.

It’s a clearly-written book, covering concisely ground that will be familiar to economists working on this territory, and providing a useful overview for those not familiar with the debate. Although I’m not a fan of UBI, the other policy prescriptions seem perfectly sensible – perhaps too sensible to be inspiring.

I must say that my other recent read has made me even more sceptical about the scope for AI to take over from humans. Recently I noted there has been a wave of terrific books on AI. Add to the list Janelle Shane’s You Look Like A Thing and I Love You. You’d be absolutely mad not to read this bok. It had me in hysterics, while making it super-clear what’s hype and what’s realistic about current and near-future AI. And explaining why image recognition AI is so prone to seeing giraffes – many giraffes – where there are none. An absolute must-read.

I must say that my other recent read has made me even more sceptical about the scope for AI to take over from humans. Recently I noted there has been a wave of terrific books on AI. Add to the list Janelle Shane’s You Look Like A Thing and I Love You. You’d be absolutely mad not to read this bok. It had me in hysterics, while making it super-clear what’s hype and what’s realistic about current and near-future AI. And explaining why image recognition AI is so prone to seeing giraffes – many giraffes – where there are none. An absolute must-read.