Hidden Games: The surprising power of game theory to explain irrational human behaviour by Moshe Hoffman and Erez Yoeli does exactly what it says on the cover. It’s an interesting strategy (ahem): irrational behaviour turns out to be rational after all! When being over-optimistic about our own abilities, fooling ourselves by only believing social media comments that reinforce our prior beliefs, spinning the truth, or over-spending on costly luxury goods, all these and more behavioural phenomena can be explained as dominant strategies in appropriately described games. It’s all about the Nash equilibria, stupid.

I enjoyed the book on the whole. It’s a breezy introduction to game theory applications, written with a light touch and plenty of anecdotes. An early chapter sets the scene with the classic evolutionary explanation for observed sex ratios, moving on then to the Hawks and Doves game, and of course the Prisoners’ Dilemma features extensively too.

It has always astonished me how few people think strategically at all, such that a read of the classic (1993) Thinking Strategically on how to apply game theory by Avinash Dixit and Barry Nalebuff would help almost anybody. I can remember once observing in a committee meeting (all economists) what the Nash equilibrium in a certain policy situation involving all EU member countries would be, which did my reputation among those colleagues a power of good as this made it obvious what decision our (UK) politicians would take, regardless of any economic advice we delivered.

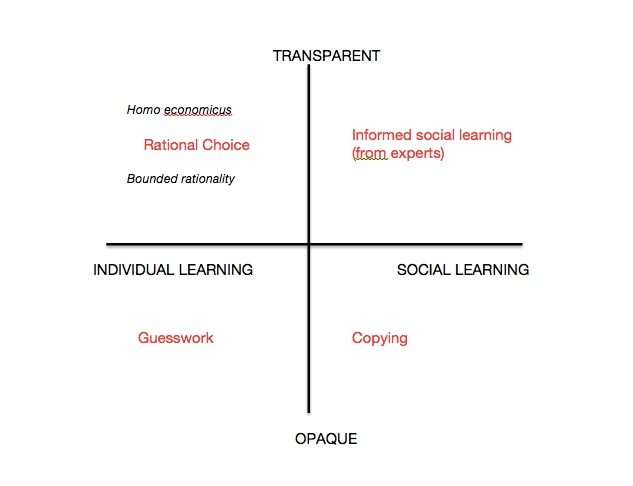

Hidden Games does some of the same groundwork as Thinking Strategically in its first half, throwing in a brief explanation of Bayes theorem en passant. I found it less compelling when it gets to the second half, explaining the ‘irrational’ as Nash equilibria in various games. Perhaps this is because there are already pretty powerful models, whether cognitive – eg the rule-of-thumb argument about conserving brain energy in making decisions – or economic – classic signalling models. The application of game theory seems more interesting in contexts of collective choices (as in Kaushik Basu’s wonderful The Republic of Beliefs) than in individual decision-making.

Having said that, if you don’t mind the trope about rationalising the irrational, Hidden Games is a very nice introduction to applying game theory to life, an enjoyable read.