I very much enjoyed reading Cesar Hidalgo’s [amazon_link id=”B00R3C1V0Q” target=”_blank” ]Why Information Grows: The evolution of order, from atoms to economies[/amazon_link]. It’s a very original perspective on the process of secular economic growth, bringing together not only several strands of the economics literature – growth theory, institutional economics, social capital etc – but also physics, biology and information theory. So it’s certainly ambitious, and I found it largely persuasive.

[amazon_image id=”B00R3C1V0Q” link=”true” target=”_blank” size=”medium” ]Why Information Grows: The Evolution of Order, from Atoms to Economies[/amazon_image]

Hidalgo’s first point is that we are misled by thinking of the information economy as ‘weightless’ (a term I think I coined, or at least popularised, in my 1996 book The Weightless World) into forgetting that information is nevertheless physical. “Information is not a thing; rather, it is the arrangement of physical things. It is physical order.” He links the order of the economy to the order of the universe that can exist in pockets despite entropy. Economic order comes about through information embodied in things (‘crystallised imagination’) and in the way people organise themselves to apply knowledge and know-how. The first section is rather poetic. Hidalgo describes a tree as a computer powered by sunlight. “A tree processes the information that is available in its environment.” He describes a colleague at MIT who lost both his legs to frostbite while mountaineering, and built his own prosthetics: “He is walking on solidified pieces of his own imagination.”

The book goes on to consider products imported and exported by countries in terms of ‘crystallised imagination’, which requires “an enormous amount of knowledge and know-how.” Knowledge is the set of instructions – a book describing how to play a guitar – and know-how is the practical experience enabling application – the process of learning and practising playing to produce lovely music. Hidalgo introduces the concept of a ‘personbyte’ – the limit to the knowledge and know-how that can be embodied in one individual. For an economy to go beyond that requires collective organisation. He argues against the normal economic argument that economic development is the process of acquiring the ability to consumer more goods and services. “Economic development is based not on the ability of a pocket of the economy to consumer but on the ability of people to turn their dreams into reality.” (This part doesn’t wholly convince me – it’s an appealing case but surely consumption matters too.)

The book then turns to the idea of the economy as a social and technological system for amplifying knowledge and know-how, and looks at institutional economics and the role of social capital in growth in this context. Conveying know-how is difficult, and becoming more so as time goes by and the economy becomes more diverse and complex. The “computational capacity” of the economy needs to grow, but it is constrained by the ability for knowledge and know-how to be embodied in networks of people – hence the value of trust, as it makes that easier.

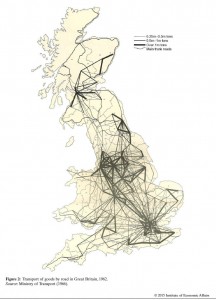

Hidalgo’s work on the [amazon_link id=”B00OX8YWZE” target=”_blank” ]Atlas of Economic Complexity[/amazon_link] enters here: there is a strong positive correlation between a complexity index and long term growth (over 10 years). The falling cost of communications and the emergence of standards have increased the number of long-distance market links (instead of transactions within single firms), and this know-how transfer is made far easier by high trust, which enables larger networks. Low trust economies are often characterised by more family firms and rely more on the state to spread knowledge and know-how through its support for industries.

There is a very nice analogy of the economy as a jigsaw. “Moving a complex industry is like trying to move a jigsaw puzzle from one table to another. The more pieces in the puzzle, the harder it will be to move it, as the puzzle falls apart when we fail to move all the pieces at the same time.” It is easier to move just a few pieces to another table that already has part of the puzzle in place. Thus economies mostly grow out from their earlier set of products, which embody the know-how they already have – they already have some of the pieces. The description of this process would very much appeal to evolutionary economists.

A final point that very much intrigues me is measuring growth. Hidalgo makes the same point as the final chapter of my [amazon_link id=”0691156794″ target=”_blank” ]GDP[/amazon_link] book, that in adding things up in terms of their monetary value we are not capturing the value of diversity: three spoons are not as valuable as a knife, fork and spoon. He says that using market price denomination to aggregate implicitly assumes there is friction-free trading; but this is often not possible, especially with stock variables. He advocates looking at the disaggregated economy via input-output tables. “The mix of products exported by a region’s industries represents a fingerprint of its productive capacities that does not suppress the identity of the economic elements involved.”

So a highly recommended read for anyone interested in economic growth and development. The insistence on the embodied-ness of knowledge and know-how is surely correct, and also a useful corrective to overly-abstract accounts of economic development, including quite a lot of the newer institutional literature (as [amazon_link id=”1783601329″ target=”_blank” ]Morten Jerven [/amazon_link]argues, this often amounts to the advice to poorer countries to “be more like Denmark”, ignoring the trajectory from here to there). It’s also a pleasure to read such a well-written economics book; from now on I’ll be envisioning the economy in terms of crystals of imagination.