Yesterday I attended an interesting session trying to identify specific reforms to the banking system – competition policy, regulatory change, consumer-facing advice and so on – run by the Finance Innovation Lab. The event ran under the Chatham House Rule so I can’t be specific about who said what. There were some very thoughtful comments, however.

– there are large (private) economies of scale in finance but large (social) diseconomies of scale. How should competition and other policy interventions change to reflect the latter?

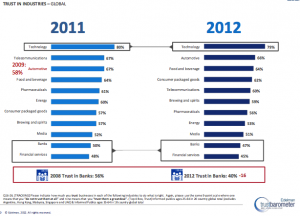

– financial services lies at the bottom of the Edelman trust barometer, tech companies at the top. Why this contrast, when finance is also an IT-intensive information business – what does it tell us about finance?

Edelman – trust in industries

– is low trust an opportunity to bring about change?

– the big incumbent UK banks simply can’t lend to SMEs as they’re too big. If Lloyds wants to grow its £1 trillion balance sheet by a modest 5% a year, it will be looking to lend to hedge funds, not people or small businesses.

– the cost of financial intermediation has not fallen despite the growth in the finance sector; Thomas Philippon’s paper ‘Has the US finance industry become less efficient?’ was cited.

I can talk about my own contribution, which was my usual riff about competition: UK (retail) banking is not a ‘market’ as there is no entry and no exit, only failed or unprofitable new entrants; the incumbent UK banks’ back-book of inert deposits combines with other barriers to make entry impossible, and they might need to be broken up, not just into retail and investment banks, but into smaller units altogether; banking is the only dinosaur industry not yet made extinct by digital disruption, but it’s ripe for this – if only regulators will make it possible for new technology-based entrants with entirely different business models. I’m not wildly optimistic about this. The regulators know this in principle but they don’t have the understanding or staff or contact with new start-ups to enable it.

Another speaker was Professor Richard Werner of Southampton University, whose contribution I can describe because he’s published it in [amazon_link id=”1908506237″ target=”_blank” ]Where Does Money Come From? A Guide to the UK Monetary and Banking Sytem[/amazon_link]. He talked persuasively of the need for regional or local institutions with detailed knowledge of local businesses. He also quite rightly pointed out that almost nobody understands money, not least because all the textbooks he has ever looked at get it wrong (I agree!). I didn’t buy his argument for centralised, state-owned money creation. But I’ll read his essay in the book to give the argument a chance.

[amazon_image id=”1908506237″ link=”true” target=”_blank” size=”medium” ]Where Does Money Come From?: A Guide to the UK Monetary & Banking System[/amazon_image]