The great Dani Rodrik is giving the S T Lee public lecture in Cambridge on 15th January 2026 (free but please book a ticket if you want to attend). The subject will be his new book, Shared Prosperity in a Fractured World.

The book is an excellent synthesis of Dani’s work in recent years, structured around making the case that trade-offs between the policy objectives of eradicating poverty, tackling climate change, and preserving democracy can be alleviated or even removed. Typically, for example, measures to boost growth in low income countries might be seen as in conflict with preserving jobs for middle class voters in rich countries. The book argues that shifting the poverty-reduction focus to creating service sector jobs (not manufacturing as in the old version of globalisation) mitigates that conflict of objectives.

The book also urges pragmatism: Act at the level of the nation state as global agreements move further out of reach; Accept second-best remedies; Be willing to experiment. After diagnosing where globalization went wrong, the book has individual chapters on pragmatic policies for green transition, good middle class jobs in high income countries, and growth through the service sector in lower income countries.

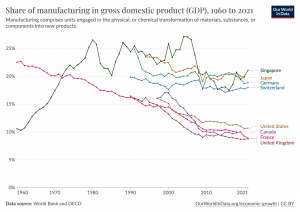

These together constitute what he calls the ‘productivist paradigm’ – ‘productivism’ is a term I don’t like as it conjures up old-style industrial policies, although I don’t have a better one. I’m also decreasingly keen on the manufacturing vs services dichotomy at all as production occurs in networks or ecosystems that involve both, and high-value services are often linked to high-value manufacture.

Anyway, the productivist paradigm also involves a more active partnership between state and market as neither, alone, leads to an efficient allocation of resources. The final chapter turns back to globalization and calls for a version built around the provision of global public goods. I’m not sure I see much prospect for any activism on global governance at present.

Still, a constructive argument for an active approach to structural transformation in the interests of populations globally is very welcome. Tune in for the lecture!