Two hundred pages into Piketty’s [amazon_link id=”067443000X” target=”_blank” ]Capital in the 21st Century[/amazon_link], I’ve found plenty of interest but am not yet bowled over as some reviewers have been. Still, 400 pages to go. I’m not going to live tweet the reading experience but will pick up on some interesting points as I go along before perhaps attempting an overall review.

[amazon_image id=”067443000X” link=”true” target=”_blank” size=”medium” ]Capital in the Twenty-First Century[/amazon_image]

A mere 58 pages in, I was calling out ‘hear, hear’ when I read this:

“One conclusion stands out in this brief history of national accounting: national accounts are a social construct in perpetual evolution. They always reflect the preoccupations of the era in which they were conceived. We should be careful not to make a fetish of the published figures.”

This is needless to say completely in harmony with my own view in [amazon_link id=”0691156794″ target=”_blank” ]GDP: A Brief But Affectionate History[/amazon_link].

[amazon_image id=”0691156794″ link=”true” target=”_blank” size=”medium” ]GDP: A Brief but Affectionate History[/amazon_image]

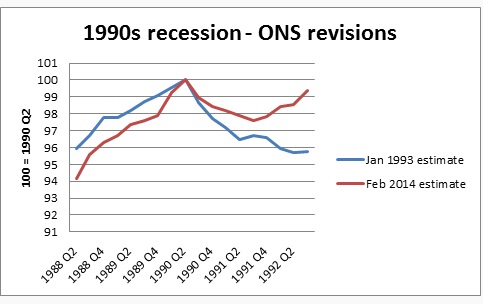

Too many economists pay no attention to the figures they are using, simply downloading time series from handy databases and telling stories around them. This chart showing ONS revisions to 1990s UK GDP data (or something similar) should be pinned above every economist’s desk as a reminder that the figures, although they’re all we have to measure the tide of economic events, are as broad brush as can be. The late 80s boom was even boomier than we remember, but the subsequent bust far less severe. As a reminder, there were a few things happening in 1992 – a general election in April, double digit interest rates in the summer, ‘Black Wednesday’ in September.

The present national accounts – as I describe in my book – co-evolved with Keynesian macroeconomics. The accounting identity C+I+G+(X-M) segued into the theory of aggregate demand and its successors. We’re stuck with GDP until the next Keynes conceives a theory of aggregate dynamics fit for a largely intangible, service and information driven economy, when there will have to be a different statistical framework.

PS I should add that it was @BenChu_ who alerted me to the 1990s revisions

Hello Diane – I put that chart together myself using the ONS revisions database and tweeted it out on Tuesday (@benchu_) – any chance of a credit/hat-tip?

Best

Ben Chu

Economics Editor

The Independent

Thanks Diane!

Also – there’s a good and comprehensive ONS analysis of the revisions to the 1990s revisions here (Annex D):

http://www.ons.gov.uk/ons/rel/naa1-rd/national-accounts-articles/updated-analysis–why-is-gdp-revised-/index.html

My PS and your comment crossed in the post – I saved it from your tweet when I was in Paris earlier this week and belatedly realised today where I’d got it from. Please do add a link to your article if you wrote it up as well as tweeting. Many thanks.

Have you seen JK Galbraith’s ‘not bowled over’ review at http://www.dissentmagazine.org/article/kapital-for-the-twenty-first-century ?

No – thanks for the link, look forward to reading it.